BPT

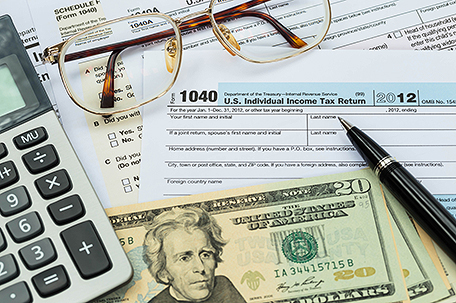

The Affordable Care Act (ACA) brings a lot of changes to this year’s tax code. Do you know if and how it will affect your tax refund?

Here are five tips from H&R Block to help you understand how your taxes and tax refund will be affected as a result of the biggest tax code change in more than 20 years.

1. Understand what will be different on your return as a result of the ACA.

The ACA has created a new intersection between health care and taxes. Starting this year, three elements are administered through your tax return, including:

• Reporting if you and members of your household have qualified health insurance.

• Accounting if you received any government assistance to help pay for your health insurance through your state’s exchange or HealthCare.gov.

• Determining a penalty, or exemption, if you, or someone in your household, don’t have insurance.

2. Be aware if you fall into one of the two main categories that could be affected the most:

• You purchased insurance through the federal marketplace or state marketplace.

• You don’t have insurance and may have to pay the tax penalty.

If one of these applies to you, you might see the biggest change on your tax return.

3. If you received the Advance Premium Tax Credit, understand what will happen at tax time this year to settle up your credit.

If you or someone in your household received the credit, you must file a tax return so the credit can be reconciled. The estimated income you reported will be compared to your actual income. This could affect you in two ways:

• If your actual household income was more than you estimated, you may have to pay back some or all of the credit you received – up to the maximum repayment cap amount. This will likely reduce the amount of your tax refund, or add to your taxes due.

• If your actual household income was less than you estimated, you may get money credited to your return.

4. Determine if you qualify for an exemption

Many people may qualify for an exemption to reduce or eliminate their ACA tax penalty. More than 30 available exemptions can apply, and they fall into two categories:

• Exemptions you claim on your tax return.

• Exemptions granted by the Health Insurance Marketplace.

5. Complete and bring the necessary forms.

If you or a member of your household received the Advance Premium Tax Credit, you will receive the new form 1095-A from the marketplace. Don’t forget to bring this form to your tax appointment – your tax return cannot be completed without it. It should be mailed to you by the marketplace by the end of January. If you don’t receive it, you should be able to access a copy through your marketplace account or by contacting the marketplace.

The bottom line is that the ACA could significantly impact your tax refund this year. One way to plan ahead this tax season is to visit your local H&R Block office on Jan. 8. Most H&R Block offices nationwide will be open from 9 a.m. to 9 p.m., giving consumers the opportunity to come in without an appointment and speak to an H&R Block ACA Specialist who can provide a no-charge ACA Tax Impact Analysis – your personalized review of how your taxes may be affected by the Affordable Care Act. You can also visit the H&R Block ACA website www.hrblock.com/acataximpact for easy-to-understand ACA information, infographics, videos and FAQs.

Leave a Comment