ABOVE PHOTO: (Photo courtesy: Kendall Alexander)

By Kendall Alexander

@SteezieKBreezie

No one likes to talk about debt…no one.

It gets uncomfortable to think about, let alone discuss. Couple that anxiety with the cost of an education, and the perfect recipe for insomnia is created.

No one should have to be punished in this country for valuing higher education. USA Today College recently reported in a study that, tuition for private four-year institutions has risen in some cases to an astronomical 3.9 percent annually. Students and their families always scramble to find ways to pay for what is supposed to be a wonderful moment in young adulthood, while taking out as few student loans as possible. When graduation arrives, within six months the grace period is over, and it’s time to pay for the four years of hard work, sleepless nights, financial run-around, and campus memories. Student debt can feel overwhelming to eliminate, and it is hard to remain calm when facing it.

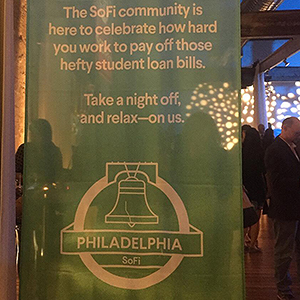

Finance company SoFi (Social Finance) says they understand the pain associated with student debt, so they threw a party about it.

SoFi– founded at Stanford University in 2011 by students for students with debt—wanted to help folks pay their debt off sooner with a lower interest rate so they can move on to the other milestones in life they want to achieve such as homeownership, traveling the world, and starting a family.

Pop-up parties are hosted nationwide by SoFi in order to build their community, network, and drum up potential membership. Seeing 350,000 members join since inception and 35,000 actively attending various events, business is steadily growing for the company. “The events always sell out so our problem is trying to create more events for people so that we can meet all the demand,” Claire Arthur of the SoFi Community Team explained.

(Photo courtesy: Kendall Alexander)

Last Thursday, SoFi touched down at Front and Palmer to host a Cocktail Party for Millennials with Student Loan Debt that included mouthwatering bites from Feast Your Eyes Catering, giveaways, and an awesome DJ set. Marketing for the party was as follows: ‘SoFi is here to celebrate by inviting you to gather together, take a night off and relax–on us. Student debt is your ticket in the door. Just bring an email, screenshot, or paper statement with your loan balance–and a friend. SoFi will take care of the rest. SoFi believes that student debt should open doors to education, to a vibrant community, to opportunity, to your dream job, and every once in awhile to a ridiculously awesome party.’

SoFi promised a good time, and they delivered. The event was fun and energetic with a club/lounge feel while appealing to members of the SoFi community and those interested in membership. Claire Arthur of the SoFi Community Team says the party for a purpose is for folks to celebrate themselves.

“The whole purpose of the event is to really celebrate people who have made a big investment in themselves by taking out student loans,” Arthur said. “Philadelphia has so many great universities and colleges, and so we know there’s a lot of people here who have graduated who have student loan debt. Usually, they’re [people] working super hard to be financially responsible, and they may not have access to this kind of thing [mixer] and SoFi is treating them to that.”

If the parties don’t sell you, what about the savings?

“The average member saves about $23,000 over the life of their loan, so the savings are going to help you move on to other financial milestones, and we have all kinds of member services to help you accelerate your success, the community events are just a small part of that,” Arthur said.

Joe Slavin, a chemical manufacturer, decided to look into SoFi and determined it was the best option for him and his family.

“I had no idea that I could roll everything in,” Slavin said. “They call us H.E.N.R.Y.s which is High Earners but Not Rich Yet, so that’s the target they’re going after, and we fit into that pretty well and we wanted to lower our student interest rate and pay it off as soon as possible. I was paying a ton in interest and I just needed another way to put more towards principal and less towards interest and pay that faster so, the math worked out.”

SoFi looks to build a real sense of community with members through these gatherings, as professional relationships have grown from mixers and events they have hosted.

Leave a Comment